Depreciation formula for rental property

This is known as the. From there we take.

Form 4562 Rental Property Depreciation And Amortization

Half of this we are using for personal use and half for rentTotal cost of land which is used is 200000.

. Calculating Depreciation In Rental Property This formula is used to calculate depreciation. Plus closing costs qualified for depreciation 3000 Cost basis 369000 Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation. Calculate Rental Property Depreciation Expense.

Depreciation is calculated by determining the cost basis and the total amount paid to acquire the property. We assume the half-year convention and begin our calculations using the MACRS depreciation. To calculate the annual amount of depreciation on a property you divide the cost basis by the propertys useful life.

The formula for a 150 declining balance will be very similar to the 200 declining balance depreciation formula. All that one needs to do is to replace the 2 200 with 15 150. Lets say you purchase a property for 250000 and the assessed land value is 50000.

This includes any installation costs attorney fees etc. This is derived from 25000 in rental. Suppose we have duplex and its cost is 315000.

Heres a quick example of how real estate depreciation for commercial property. If the home was not available for rent for the full year divide. Say a company purchases agricultural equipment worth 50000 in 2015.

To calculate the depreciation cost of a property divide the basis cost by the recovery period which is 275 years for residential income properties. To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years. Under the most commonly used United States tax rules.

F 250000 1 004 5. Depreciation rates are based on the effective life of an asset unless a write-off rate is prescribed for some other purpose such as the small business incentives. In our example lets use our existing cost basis of 206000 and divide by.

In straight-line depreciation real estate is reported on a tax form as losing value in equal amounts over the allowed life of the property. In this case since residential rental property can be depreciated for 275 years you would depreciate 4589 per year. To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years.

If the cost of land is also. Straight line depreciation is the most commonly used method to calculate depreciation where the value of the rental property is evenly distributed throughout each year. That leaves the building or improvement value at 200000.

Cost of the Building - Value of the Land Building Value Building Value 275 Yearly allowable.

The Four Returns In Real Estate Cash Flow Is Not Everything

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

How Is Property Depreciation Calculated Rent Blog

Real Estate Investing Rules Of Thumb

Rental Property Cash On Cash Return Calculator Invest Four More

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Free Construction Cost Calculator Duo Tax Quantity Surveyors

How You Can Make Money From Your Rental Show A Loss On Your Tax Return Semi Retired Md

Investment Property Excel Spreadsheet Rental Property Rental Property Investment Investment Property

Converting A Residence To Rental Property

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Depreciation Schedule Formula And Calculator

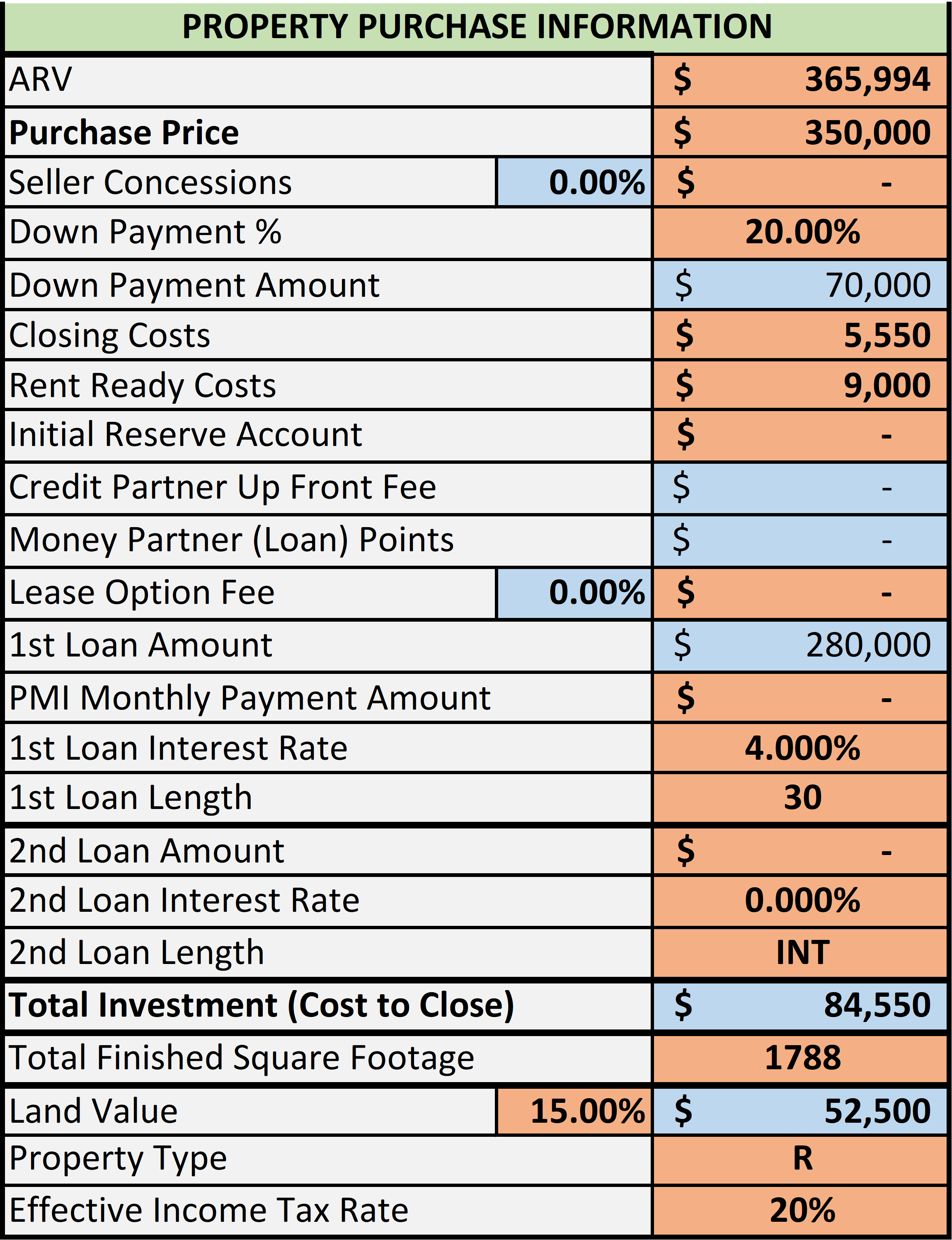

I Put Together A Spreadsheet For Evaluating Rental Properties Would Love Some Feedback R Realestateinvesting

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

Investing Rental Property Calculator Mls Mortgage Real Estate Investing Rental Property Rental Property Management Real Estate Investing

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Rental Yield Calculator